In order to discover the information for the foundations of an effective digital marketing strategy, you must first understand your underlying vertical industry. After you have completed the full analysis you should be able to:

- Identify your position and the position of your competitors in the industry on a chart based on two product or service categories that are considered important within your vertical market

- Identify opportunities and threats within your market (SWOT Analysis)

- Highlight the strengths and weaknesses of your organization

- Pinpoint where strategic opportunities lie and which will return the best ROI.

Competitive analysis is the process where you identify your competitors and evaluate their strategies to discover their strengths and weaknesses. You also need to weigh and compare your own strategies, strengths and weaknesses. This process may make you feel uncomfortable, but will, in the long run, make for more successful strategy development. The information you discover from this process should be used to shape your marketing plan and strategic implementation.

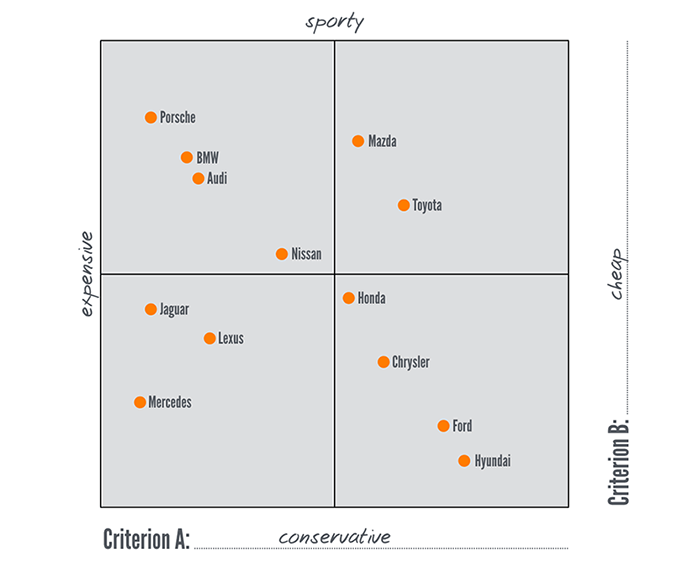

Before you start digging into the finer details, start by making an industry wide ‘competition grid’. Start with a single spreadsheet and define the qualities you are going to use to compare and contrast (e.g., Price, Quality, Timeliness, Capacity, Expertise, etc.). Once you have listed and defined your competition, you can then rate and graph your company on a grid with your competition using the different qualities based upon differing buying parameters. See the example below:

You can customize your graph by using varying size points to identify your competitors by sales volume or product line quantity. You may want to create several graphs utilizing differing criteria to round out the scope of your positioning.

Process

- Find your competitors. There are many avenues to discover all your competitors. Competitors can be defined as direct or tangential. Often competitors are defined as ‘real world’ for competitors who compete with you in head-to-head battles for work. Tangential competitors could deal with companies that are competing for your shared digital space. A simple Google search will help you define both kinds of competitors. You should also use industry directories, sales collateral, ThomasNet directories, and sales information. This part of the process can be time consuming but the number of competitors you identify may surprise you.

- Categorize your competitors.

- Direct Competitors – These are the companies that target the same market as your company or their products/services compete with your offering.

- Secondary Competitors – Often companies offer similar products/services to you but are in different markets that are slightly different based on quality, accuracy or standard specifications. These companies may also bundle similar services or products to make new categories of offerings.

- Tertiary Competitors – These are competitors that are tangentially related to your products/services. These may come to play later when identifying new market research or digital space interference.

- Direct Competitors – These are the companies that target the same market as your company or their products/services compete with your offering.

- Examine your competitor’s digital presence.

- Content – evaluate the breadth and reach of content topics, product imagery, writing quality, presentation quality.

- Where are their ‘Call To Action’ on their website and digital correspondence.

- Are they collecting data through forms for an email contact list?

- Check their social media accounts to see whether they have activity.

- Blog? Yes or no; How frequent? What kind of topics?

- Is their website mobile ready (responsive)?

- Methods of contact? Email? Phone? Pop-up chat box? Contact form?

- Sign up for email response. Use an anonymous email account to test their response rate, timing, and effectiveness.

- Content – evaluate the breadth and reach of content topics, product imagery, writing quality, presentation quality.

- Identify your Competition’s market position. Take a look at each competitors website and marketing message. What exactly is their leading differentiator? What are their key selling features? What makes their product/service unique (according to them)?

- Pricing. This may require some investigation and digging. You may need to ask your most trusted customers what their experience or perception of the pricing landscape is in your market. You may want to identify any trends or shifts in the pricing and if the product offering has evolved or adapted.

- Weaknesses. Look at your competition and set some parameters for where they may be experiencing problems or are subject to errors. Do they have limited capacity? How successful are they at meeting tight deadlines? Are they in a geographic advantage or disadvantage to your operation? How responsive are they to outside factors and industry change?

- Reputation. Check online reviews and social media for any complaints or bad reviews. Also, check online employment boards and see what their reputation is as an employer.

- Additional information enhancements.

- Gritty Details. How long have they been in business/ Date of their online domain registry? Is their contact info correct and up to date wherever you find them? Start with Whois?

- See if they’re hiring and for what positions? Go to several jobs boards and search them and see what kind of activity they have had. Also, check their internal career page for job postings.

- Find out about funding. What kind of backing do they have? What was the last infusion of cash? Are they seeking more? Start with https://www.crunchbase.com/

- Stay updated using Google alerts for any updates or news on all of your competitors as well as your vertical market.

- Gritty Details. How long have they been in business/ Date of their online domain registry? Is their contact info correct and up to date wherever you find them? Start with Whois?

MARKiT can get you started and help get your digital marketing up to the next level. We offer a free marketing evaluation meeting where we can discuss what your next steps should be. Call or email us today to reserve a meeting time.